Best Tools to Screen for Gap Up Stocks to Buy in November 2025

ablieve Stock Market Invest Day Trader Trading Mouse Pad Chart Patterns Cheat Sheet,Large Computer Mouse Pad/Desk Mat with Stitched Edges 800x300mm 0320

- EXTRA-LARGE SIZE FITS ALL SURFACES FOR ULTIMATE WORKSPACE COMFORT.

- NON-SLIP BASE KEEPS YOUR MOUSE PAD SECURELY IN PLACE DURING USE.

- DURABLE STITCHED EDGES ENSURE LONG-LASTING PERFORMANCE FOR GAMERS.

JIKIOU Stock Market Invest Day Trader Trading Mouse Pad Chart Patterns Cheat Sheet,X-Large Computer Mouse Pad/Desk Mat with Stitched Edges 31.5 x 11.8 in

-

MAXIMIZE TRADING SUCCESS: UNIQUE DESIGN INSPIRES STOCK MARKET VICTORIES!

-

USER-FRIENDLY LAYOUT: ORGANIZED PATTERNS AND INDICATORS FOR EASY ACCESS.

-

DURABLE QUALITY: NON-SLIP BASE AND WEAR-RESISTANT EDGES ENSURE LONGEVITY.

Day Trading Flash Cards - Stock Market Chart & Candlestick Patterns, Instructions to Trade Like a Pro!

-

BOOST YOUR TRADING SKILLS: PERFECT FOR ALL LEVELS, QUICK LEARNING!

-

PORTABLE & DURABLE: HIGH-QUALITY CARDS FOR ON-THE-GO TRADING!

-

ENHANCED 2ND EDITION: UPDATED PATTERNS FOR BETTER DECISION-MAKING!

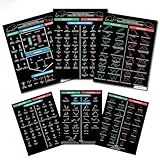

12Pcs Trading Chart Pattern Posters Candlestick Pattern Poster Bulletin Board Crypto and Stock Market Trading Poster Office Decorations for Trader Investor Supplies Wall Door Decor 11 x 15.7 Inches

-

ALL-IN-ONE SET: 12 POSTERS & 100 ADHESIVE DOTS FOR EASY SETUP!

-

SLEEK DESIGN: CLEAR TRADING PATTERNS ENHANCE ANY WORKSPACE.

-

DURABLE QUALITY: THICK, LAMINATED CARDS ENSURE LONG-LASTING USE.

Stock Trader's Almanac 2025 (Almanac Investor Series)

4X Trading Journal for Day Traders | Trade Log Book for Stocks, Forex, Options, Crypto | 12 Week Plan with 80 Trades | Trading Accessories | Neuroscience Based with Guided Trading Plan | Traders Gift

- ELEVATE YOUR TRADING: ENHANCE STRATEGY WITH NEUROSCIENCE-BASED INSIGHTS.

- ORGANIZED SUCCESS: DEVELOP WINNING PLANS WITH STRUCTURED TRADE SECTIONS.

- TRACK & PROGRESS: ANALYZE 80 TRADES FOR CONTINUOUS SKILL IMPROVEMENT.

Candlestick Pattern Cheat Sheet for Trading – 3-Page Durable Cardstock with 190+ Chart Patterns – Includes Candlestick and Traditional Technical Analysis for Stock, Crypto, and Forex Traders

- ACCESS 190+ PATTERNS FOR FASTER MASTERY IN TRADING STRATEGIES.

- MAKE INFORMED TRADES USING PROVEN HISTORICAL PATTERN INSIGHTS.

- DURABLE, PORTABLE CARDS DESIGNED FOR QUICK VISUAL RECOGNITION.

Latonyar Stock Market Invest Day Trader Trading Mouse Pad, Chart Patterns Cheat Sheet, Large Computer Mouse Pad/Desk Mat with Stitched Edges, Multi-color/Pattern, Rubber, 800x300x2mm

-

SPACIOUS DESIGN: FITS BOTH KEYBOARD AND MOUSE FOR ULTIMATE COMFORT.

-

BUILT TO LAST: ANTI-FRAY STITCHING ENSURES LONG-LASTING DURABILITY.

-

CLEAR EDUCATIONAL GRAPHICS: EASY-TO-READ STOCK MARKET INFO FOR LEARNERS.

Trading: Technical Analysis Masterclass: Master the financial markets

- MASTER FINANCIAL MARKETS WITH EXPERT TECHNICAL ANALYSIS TECHNIQUES.

- PREMIUM QUALITY MATERIALS ENSURE DURABILITY AND LONGEVITY FOR READERS.

- ENHANCE TRADING SKILLS WITH PRACTICAL INSIGHTS FROM A MASTERCLASS EXPERT.

Charting and Technical Analysis

- ENHANCE TRADING STRATEGIES WITH ADVANCED CHARTING TOOLS.

- GAIN MARKET INSIGHTS THROUGH IN-DEPTH STOCK ANALYSIS.

- MASTER TECHNICAL ANALYSIS FOR INFORMED INVESTMENT DECISIONS.

To screen for gap up stocks for intraday trading, traders can use technical analysis tools such as scanners and stock screeners to identify stocks that have shown a significant gap up in their price movement at the open of the trading day. These tools can be customized to filter stocks based on specific criteria such as the size of the gap up, trading volume, and price action patterns.

Traders may also look for catalysts that could have triggered the gap up, such as positive news or earnings reports. Additionally, monitoring pre-market trading activity and pre-market news can help identify potential gap up candidates.

Once potential gap up stocks are identified, traders can further analyze the stocks using technical indicators and chart patterns to assess their potential for intraday trading. It is important to set stop-loss orders and have a trading plan in place before entering a trade to manage risk effectively.

How to distinguish between a true gap up and a false gap up in trading?

A true gap up occurs when the opening price of a stock is higher than the previous day's high price. This usually indicates strong buying pressure and can be a bullish signal. On the other hand, a false gap up occurs when the opening price is higher than the previous close but lower than the previous day's high. This could be a result of pre-market manipulation or an overreaction to news, and may not be sustained throughout the trading day.

To distinguish between a true gap up and a false gap up, traders can look at the volume traded at the open, the overall market trend, and the price action following the gap up. A true gap up usually has higher volume, continues to trend higher throughout the day, and is supported by positive market sentiment. In contrast, a false gap up may see lower volume, lack follow-through, and may quickly reverse direction. Additionally, technical analysis tools such as support and resistance levels, moving averages, and chart patterns can also help confirm the validity of a gap up.

How to use limit orders when trading gap up stocks?

When trading gap up stocks, you can use limit orders to set specific entry and exit points for your trades. Here are some tips on how to use limit orders effectively when trading gap up stocks:

- Set a limit order to enter the trade: When a stock gaps up, it can be tempting to jump in at the market price. However, it is often better to set a limit order at a slightly lower price to ensure you get a better entry point. This can help you avoid overpaying for the stock and potentially increase your profits.

- Set a limit order to exit the trade: It is important to have a plan for when to exit your trade, whether it is to take profits or cut losses. By setting a limit order at a specific price, you can automatically sell the stock when it reaches that price, without having to constantly monitor the market.

- Use stop-limit orders: If you want to protect your profits or limit your losses, you can use stop-limit orders. This type of order combines a stop order, which triggers your trade at a certain price, with a limit order, which sets the price at which your trade will be executed. This can help you lock in profits or prevent large losses in volatile markets.

- Be flexible with your limit orders: It is important to adapt your limit orders as the market conditions change. If the stock is moving quickly, you may need to adjust your limit orders to keep up with the volatility. Keep an eye on the stock's price action and adjust your orders accordingly.

Overall, using limit orders when trading gap up stocks can help you make more informed and strategic trading decisions. By setting specific entry and exit points, you can better manage your risk and potentially increase your profits.

What is the significance of volume in gap up stocks?

Volume is significant in gap up stocks because it can help confirm the strength of the gap. When a stock gaps up with high volume, it indicates that there is strong buying pressure and interest from investors. This can be seen as a bullish indicator, suggesting that the stock may continue to rise in the short term.

On the other hand, if a stock gaps up on low volume, it may suggest that the gap is not as significant and may be more likely to be a false breakout. Low volume can indicate that there is not much conviction behind the price movement, making it more vulnerable to a potential reversal.

In summary, volume is an important factor to consider when evaluating gap up stocks, as it can help confirm whether the gap is likely to be sustained or is more vulnerable to a pullback.

How to use moving averages to filter gap up stocks?

Moving averages can be a useful tool for filtering gap up stocks by providing a reference point for determining the trend strength and potential support levels. Here are some steps you can take to use moving averages to filter gap up stocks:

- Select a set of moving averages to use for your analysis. Common choices include the simple moving average (SMA) and exponential moving average (EMA), with popular time frames ranging from 20 to 200 periods.

- Plot the selected moving averages on a chart of the stock you are analyzing. This will help you visualize the trend direction and identify potential levels of support and resistance.

- Look for gap up stocks that are trading above their moving averages. This can indicate bullish momentum and potential opportunities for further upside potential.

- Pay attention to the interaction between the stock price and the moving averages. For example, if the stock price crosses above a moving average after a gap up, it could signal a continuation of the momentum.

- Use the moving averages as a reference point for setting stop-loss levels. If the stock price falls below a certain moving average, it could indicate a shift in trend direction and a potential exit point for your trade.

- Consider combining moving averages with other technical indicators, such as volume analysis or trendlines, to further refine your filtering process and identify the best gap up stocks to trade.

By using moving averages to filter gap up stocks, you can better evaluate the strength of the trend and make more informed trading decisions. Remember to always conduct thorough research and analysis before making any trading decisions.

How to handle gaps that occur overnight in stocks?

There are several strategies that investors can use to handle gaps that occur overnight in stocks:

- Set stop-loss orders: Investors can set stop-loss orders to automatically sell a stock if it reaches a certain price, helping to limit potential losses if a gap occurs overnight.

- Utilize limit orders: Limit orders allow investors to specify the maximum price they are willing to pay to buy a stock or the minimum price they are willing to sell a stock for. This can help protect against large price movements that occur overnight.

- Stay informed: Keep up to date with news and events that could potentially impact the stock market and cause gaps in stock prices overnight. This can help investors make more informed decisions about their investments.

- Diversify your portfolio: Diversifying your portfolio can help reduce risk and protect against losses from gaps in individual stocks. By investing in a variety of stocks across different sectors, investors can minimize the impact of any single stock experiencing a gap.

- Use technical analysis: Technical analysis can help investors identify patterns and trends in stock prices, which can be useful for predicting potential gaps in stock prices. By using technical analysis tools, investors can make more informed decisions about when to buy or sell stocks.